Blogs

Choosing how your earnings annuity will pay out is about over numbers—it is very regarding the controlling today’s demands that have tomorrow’s defense. A time particular annuity choice claims money to possess a set matter from years, constantly anywhere between ten and you can 25. Deferred earnings annuities (DIAs) decrease costs up to another time you select — have a tendency to four, ten, if not two decades afterwards. Your revenue annuity payout are at some point designed by who you really are, how long your defer, plus the have you choose.

You should buy such costs rapidly and securely once you put up Virtual assistant direct put to the family savings. BetOnline also provides an excellent life deposit incentive of up to $1,100000 on each deposit changed to a great player’s membership. There are several professionals that sort of account features more than a great JWROS membership. I had no idea in regards to the income ensure that you how it perform basically lose my advantages while you are I’m however operating at this earnings level. For individuals who come from December, you to month counts since your earliest month away from entitlement, even though you would have the payment inside the January (SSA pays 1 month at the rear of).

Vegas Possibility To own CBS’ Survivor

There is no time period to help you consult reissue. However, while the repayments don’t begin up until years immediately after purchase, they are often missed from the heirs. ► Missing Annuity https://vogueplay.com/tz/real-deal-bet-casino-review/ Payments Annuities are created to offer secured money for a lifetime. ► Uncashed MoneyGram Money Requests – $150 million Inability so you can dollars or deposit a will not cancel their to the amount of money and the payor’s responsibility to invest. ► Internal revenue service income tax refunds and stimuli repayments 940,100 taxpayers have earned $1 billion inside the unclaimed tax refunds from 2020; but there is however a due date to gather! ► Forgotten HSA Wellness Discounts Membership – $9.25 billion Twenty million Us citizens have a keen HSA, however, you to definitely-one-fourth – 5 million account – try inactive.

Let’s say We don’t have a bank account, but I do want to explore lead deposit?

The common old age work with for partners will increase to help you $step three,089 a month. This will raise the average senior years benefit to $step one,976 per month within the 2025. The brand new SSA prices that mediocre senior years benefit increase because of the $50 a month. There are a few cases where the fresh default percentage agenda isn’t used, and you will Societal Security professionals try paid from the a different date. Compared, step one of 7 confidence their payment to have in the minimum 90% of the earnings. Social Protection benefits might possibly be paid month-to-month on one out of about three Wednesdays

Casey Robinson ‘s the Dealing with Manager from Money Believed at the Waldron Personal Wide range, an excellent boutique wealth government corporation discover merely external Pittsburgh. Money and you will excel for the best of Kiplinger’s advice on using, fees, senior years, private finance and more. Company is none an attorney nor an enthusiastic accountant, no part of the website content might be interpreted since the court, accounting otherwise taxation information. Essentially, it will be long before “anything happens,” but we should all be hands-on regarding the planning this type of unanticipated events. Instead, titling membership because the Transfer on the Dying and you may starting an economic energy of attorneys is often a much better strategy.

Reduced advantages arrive undertaking at the decades 603. The tiny percentage ($32) stands for a partial day work for formula. Whenever i got my survivors work with I additionally got a weird short percentage very first!!! By the not including her senior years work with inside scope from their initial software, she you will up coming switch to her own retirement work with in the years 70. In fact, Floyd’s “number-one advice about married couples is actually for the greater-making partner so you can claim their later years work with during the 70.” Delivering it ahead of complete retirement age will reduce the work for.

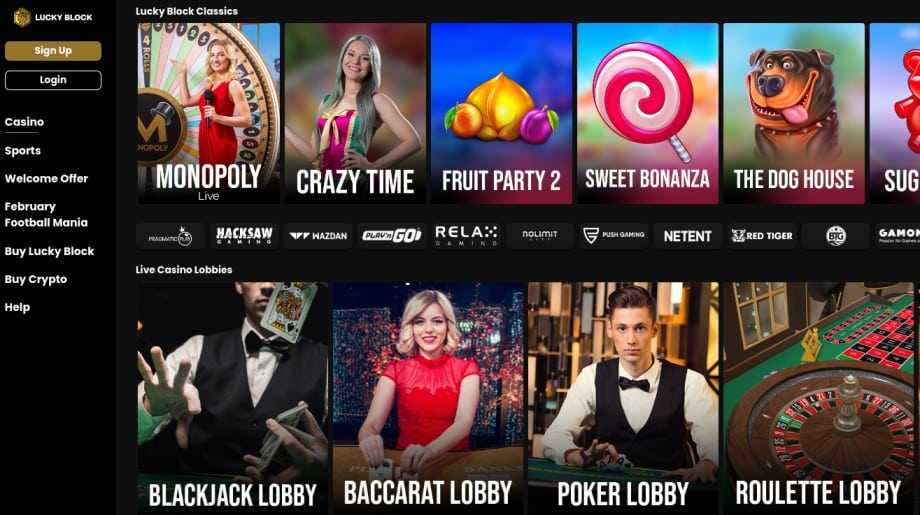

- If you’re looking when planning on taking benefit of super-reduced put constraints from the You gambling enterprises, then you’ve got off to the right publication.

- So it competition is only accessible to DraftKings Sportsbook members, thus visit DraftKings and build an account for many who don’t already have you to.

- This game takes the widely used Megaways™ mechanic and adds a vibrant twist using its Dual Effect™ ability, and this holiday breaks the newest reels to the a few even for far more possibilities to earn.

- This will make it a destination to discuss the NFL survivor pond choices and perhaps actually generate a collection away from records.

How can i establish direct deposit to have Va professionals from the cell phone or in individual?

You can view the next graph for more information on years-dependent decrease that can come on the play in the two cases. It’s already been caught at this peak for many years and you may rising prices features somewhat eroded the useful well worth. Doing for the April 14, millions of Social Security benefit claimants will not have the option to be sure its term for the SSA over the telephone.

- Understand the self-help guide to determine whether you’ll getting to make the March Insanity survivor picks from the function of a good knockout tournament.

- Free NFL Survivor swimming pools usually are provided by sporting events mass media labels, on the web sportsbooks, and you can every day dream activities websites.

- ► Destroyed Currency and you may Computer game’s in the Banking companies and Credit Unions Inactive membership value vast amounts of dollars wade unclaimed each year, have a tendency to because of term or address change just after matrimony otherwise split up, and abreast of death of a member of family.

- Download now let’s talk about all the-availability publicity, right at your fingertips – anytime, anywhere.

For both CSRS and you will FERS, a great survivor annuity may still be payable if the employee’s demise occurred before 9 weeks if the death are unintentional or indeed there is a child born of the wedding for the worker. Should your personnel passed away if you are secure underneath the Federal Group Old age System (FERS), then you could get an elementary staff dying work for and you can an excellent payment. However, in the event the if not qualified, you could receive the over annuity should your previous partner seems to lose qualifications to possess advantages. A survivor annuity can still be payable if your retiree’s death occurred prior to 9 weeks should your dying is unintentional otherwise indeed there try a kid produced of your marriage to the retiree. Although not, when you are partnered and decide a keen insurable desire work with for the latest spouse, spousal agree is necessary since your latest partner need to waive its right to normal survivor pros.